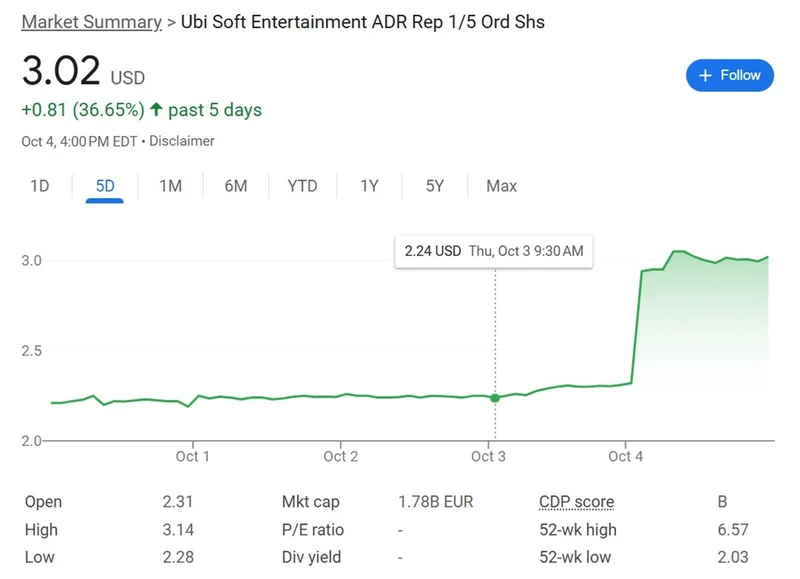

Ubisoft, the gaming giant behind titles like Assassin's Creed and Far Cry, recently requested a halt in trading of its shares and bonds on Euronext. This move, executed on November 14, 2025, came just before the anticipated release of their first-half earnings report for the 2025-26 fiscal year. The company cited a need to "limit unnecessary speculation and market volatility" pending the report's publication in the "coming days," according to an internal email from CFO Frederick Duguet. But is this a standard procedure to manage market jitters, or does it hint at something more concerning lurking beneath the surface?

Decoding the Delay

Halting trading before a major earnings release isn't unheard of, but it's far from routine. Companies typically do this when they anticipate significant, unexpected news that could trigger wild price swings. Duguet's explanation of limiting "unnecessary speculation" sounds reasonable enough, but it also raises questions. What kind of speculation were they trying to avoid? Were there whispers of disappointing figures already circulating? Or, perhaps more optimistically, were they bracing for unexpectedly positive results that could lead to a surge in Ubisoft stock price and potential accusations of insider trading if some investors knew beforehand?

The timing is also curious. Ubisoft chose to halt trading before the earnings release, not after. This suggests they were proactively trying to control the narrative, rather than reacting to market sentiment post-release. Ubisoft has scheduled a conference call following the results, accessible through the investor relations section of their website. This is standard practice, allowing analysts and investors to directly question management about the numbers. The question is, will management be forthcoming, or will they stick to carefully crafted talking points?

The Kremlin Comparison: A Sign of Eroding Trust?

The internet, as always, has opinions. One particularly blunt comment compared Ubisoft's actions to something straight out of the Kremlin's playbook, implying a lack of transparency and a potential for manipulation. While such extreme comparisons should be taken with a grain of salt, they reflect a deeper issue: eroding trust. In today's market, transparency is paramount. Any perceived attempt to control information flow can backfire spectacularly, fueling speculation and anxiety rather than quelling it.

I've looked at hundreds of these situations, and this level of skepticism is not always warranted. However, the gaming industry is notoriously volatile, with fortunes often tied to the success of a single blockbuster title. Ubisoft, despite its impressive portfolio, is not immune to these pressures. A string of underperforming releases, coupled with rising development costs, could easily spook investors. And this is the part of the analysis that I find genuinely puzzling - Ubisoft is a large company; they have the resources to handle fluctuations in revenue, so why this dramatic step?

Insider Gaming reached out to Ubisoft for clarification on the delay and trade halting. That’s good journalism. Hopefully, they’ll get a straight answer. If not, the silence will speak volumes. According to Ubisoft's CFO Tells Employee's That The Trading Halt of Stock is to "Limit Unnecessary Speculation" - Insider Gaming, the company's official statement cites a need to "limit unnecessary speculation and market volatility".

Is This Just Paranoia?

Maybe. But in the world of finance, paranoia can be a survival skill. The delayed earnings report could be a minor blip, a temporary setback before a triumphant resurgence. Or, it could be the first crack in a dam about to burst. Only time, and the actual numbers, will tell.

Smoke and Mirrors, or Just a Calculated Delay?

Ultimately, Ubisoft's move smacks of damage control. Whether there's real damage to control remains to be seen.