Market's "Extreme Fear" is Just Tuesday for Anyone Paying Attention

Another Day, Another Doom Loop

Okay, so the market's having a hissy fit. SPY and QQQ both down over 1.5%. Big deal. Apparently, the "post-shutdown optimism" has vanished. Give me a break. As if anyone actually believed that a temporary stay of execution on government funding was a reason to throw a party.

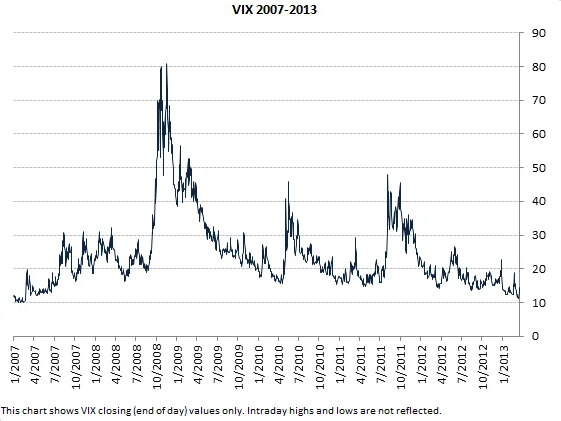

The VIX – that oh-so-reliable "fear gauge" – is up 15%. CNN's "Fear and Greed Index" is flashing "extreme fear." You know what I'm extremely fearful of? Paying $7 for a lukewarm cup of coffee that tastes like burnt tires. The market's a casino, folks. Act accordingly.

And the reason for all this manufactured panic? Oh, right, the lack of federal economic data. As if those numbers are ever anything but massaged and spun to fit whatever narrative the clowns in Washington are trying to push. Remember when they changed how they calculated inflation like five times in the last decade? Yeah, I trust those numbers about as far as I can throw a Buick.

Rate Cut Dreams Officially Dead?

The Fed, bless their little hearts, is wringing its hands about inflation still being above their sacred 2% target. Last I checked, 3% ain't exactly the end of the world. But no, gotta keep those rates high to "counter inflation." Which, in reality, just means making life more expensive for everyone who isn't already swimming in cash.

Nick Timiraos from the Wall Street Journal (aka, the mouthpiece of the establishment) notes that four Fed presidents aren't exactly screaming for a December rate cut. Well, duh. Are we really surprised? The whole "rate cut" narrative was always a pipe dream. They dangle the carrot, then snatch it away at the last minute. Rinse and repeat.

Odds of a December rate cut are now roughly a coin flip, down from a solid chance a week ago. Shocker. Meanwhile, layoffs are piling up. Challenger, Gray & Christmas (whoever they are) reported the highest job cuts for October since 2003. 153,074 pink slips. But hey, at least inflation is almost under control, right?

It's like they want a recession. Or maybe they just don't have a clue what they're doing. Both are equally plausible, offcourse.

Here's a question that keeps me up at night: are these guys incompetent, or are they actively trying to tank the economy? And if it's the latter, what's the endgame?

Meanwhile, Back in Reality...

Let's not forget about the real important news: William Levy's new movie, Bajo un volcán, is premiering on ViX on November 24th. Because, you know, that's exactly what we need right now: more escapist entertainment to distract us from the impending economic doom. Though, I admit, an action-romance film set against a volcanic eruption sounds like a pretty apt metaphor for the current state of the market.

I mean, who doesn't want to watch a military pilot and a volcanologist fall in love while dodging lava bombs? It’s produced by Secuoya Studios and William Levy Entertainment. Secuoya Studios...that name sounds vaguely sinister, doesn't it? Like they're secretly controlling the weather or something. More information on the movie can be found at ViX Premieres Bajo Un Volcán, William Levy’s First Feature Film Shot in Spain.

So Much for a Soft Landing...

Look, I'm not saying the sky is falling. But I am saying that anyone who's surprised by this market volatility hasn't been paying attention. This isn't "extreme fear." This is just Tuesday.